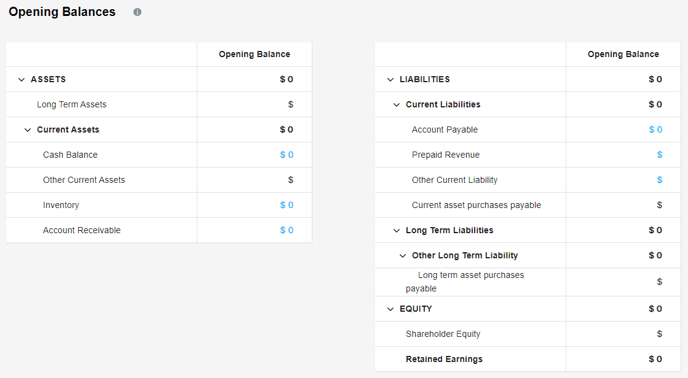

Opening balances are the balances of your assets, liabilities, and equity accounts at the start of your financial planning or accounting period.

Opening balances are brought forward from the closing balance of the previous accounting period and can be found in the Balance Sheet report of your company.

🧠When you start a NEW Business, your opening balances are zero.

💡 If your company was already in operation prior to the start of the financial period, it is essential to input the opening balances in this section ✔️

This step ensures the accuracy of your projected Balance Sheet and Cash Flow Statement, enabling them to reflect the true financial position of your company at the beginning of the period.

Accurate recording of opening balances is vital for maintaining the correctness and reliability of your financial forecasts.

📝 Edit your numbers

Keep in mind that blue-colored numbers are editable right on the spot, black numbers are calculations.

📢 Examples

- The money that you already have in your bank account on the day before your financial planning period, will be your opening balance for your Cash account.

- The money that your customers owe to you at the beginning of your financial planning period will be your opening balance for your Accounts Receivable account.

- If you already have a bank loan, the loan amount that you owe to the bank at the beginning of your planning period will be your opening balance for your Loan account.

- The money that you invested in your company will be your Equity opening balance.

-2.png?height=120&name=Modeliks%20Logo%20(blue%20modeliks%20right)-2.png)